Ivka Kalus – Founder, CIO, Portfolio Manager

Strategy Characteristics:

Portfolio Management

Seizing the alpha opportunity in gender-diverse investing.

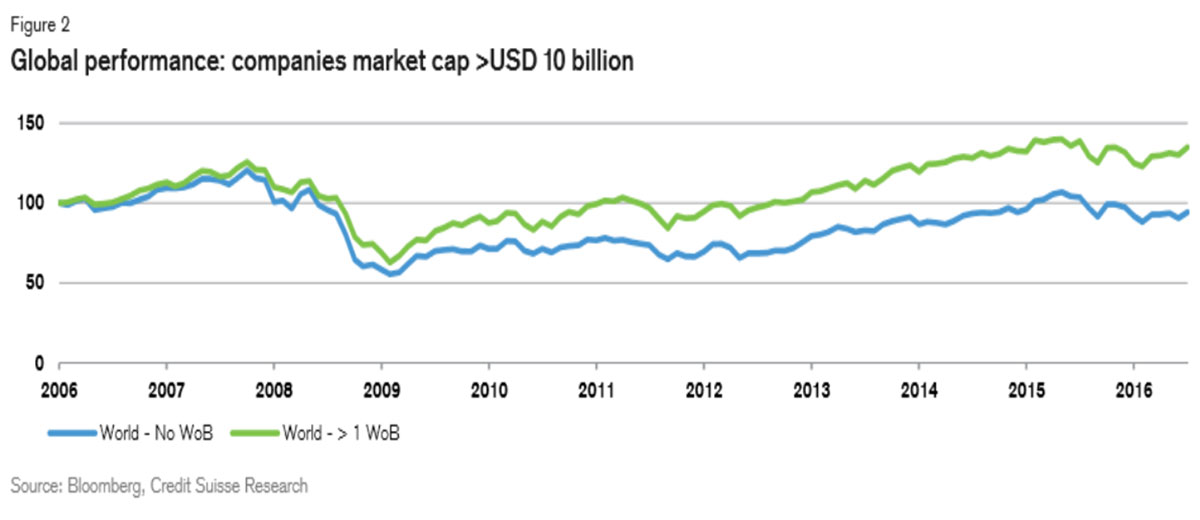

Studies1 have shown that companies with gender-diverse leadership have above market-average: profitability, value creation, innovation, risk management, employee retention/productivity and ESG scores. This leads to investment opportunities that offer financial returns and social impact to close the gender gap.

1McKinsey, Credit Suisse, BCG, BOA, MSCI Studies 2016-2018

Gender Diverse Boards Outperform

Investment Strategy

The strategy utilizes a sector and region neutral risk-controlled framework that seeks to provide long-term capital appreciation and excess returns relative to the MSCI ACWI ex U.S. Index. The portfolio invests in companies that exhibit attractive risk/return profiles and favorable ESG characteristics.The strategy utilizes a sector and region neutral risk-controlled framework that seeks to provide long-term capital appreciation and excess returns relative to the MSCI ACWI ex U.S. Index. The portfolio invests in companies that exhibit attractive risk/return profiles and favorable ESG characteristics.

Minimum Inclusion Criteria

- At least two women on the board

- At least 20% of portfolio companies will have woman CEO, CFO, COO or CTO

- Portfolio has at least 30% more women on boards, in management and in C-suite than benchmark

| Impact Results | Portfolio | Benchmark | % Better |

|---|---|---|---|

| Women on Boards | 36% | 20% | 75% |

| Women Executives | 29% | 18% | 64% |

| Women in C Suite | 58% | 9% | 547% |

| ESG Disclosure | 34 | 27 | 26% |

| ISS Quality | 4 | 5 | 32% |

| CDP | 4 | 2 | 83% |

| S&P Global Env Rank | 49 | 33 | 48% |

| Sustainalytics | 20 | 50 | 59% |

| Scope 1 GHG/Sales | 122 | 463 | 74% |

| Scope 2 GHG/Sales | 20 | 76 | 74% |

| % Unionized | 37% | 21% | 77% |

All data as of September 30, 2021 unless otherwise noted.

Respect, Diversity, Intellectual Curiosity & Rigor, Objectivity and Humility

International investing involves additional risks, including social and political instability, economic developments, reduced regulation, market illiquidity, and market volatility, and currency exchange rate fluctuations.

ESG involves additional risks, including lower returns as a result of the foregoing of certain investment opportunities based on certain industries or ESG ratings.

Investors should carefully consider the Strategy’s investment objectives, risks, charges and expenses before making an investment decision. This and other information about the Strategy, including additional risks, are contained in the Prospectus, which can be obtained by contacting us.